oklahoma franchise tax payment

And pay franchise tax. What is the corporate tax rate in Oklahoma.

2014 Form Ok Frx 200 Fill Online Printable Fillable Blank Pdffiller

For corporations that owe.

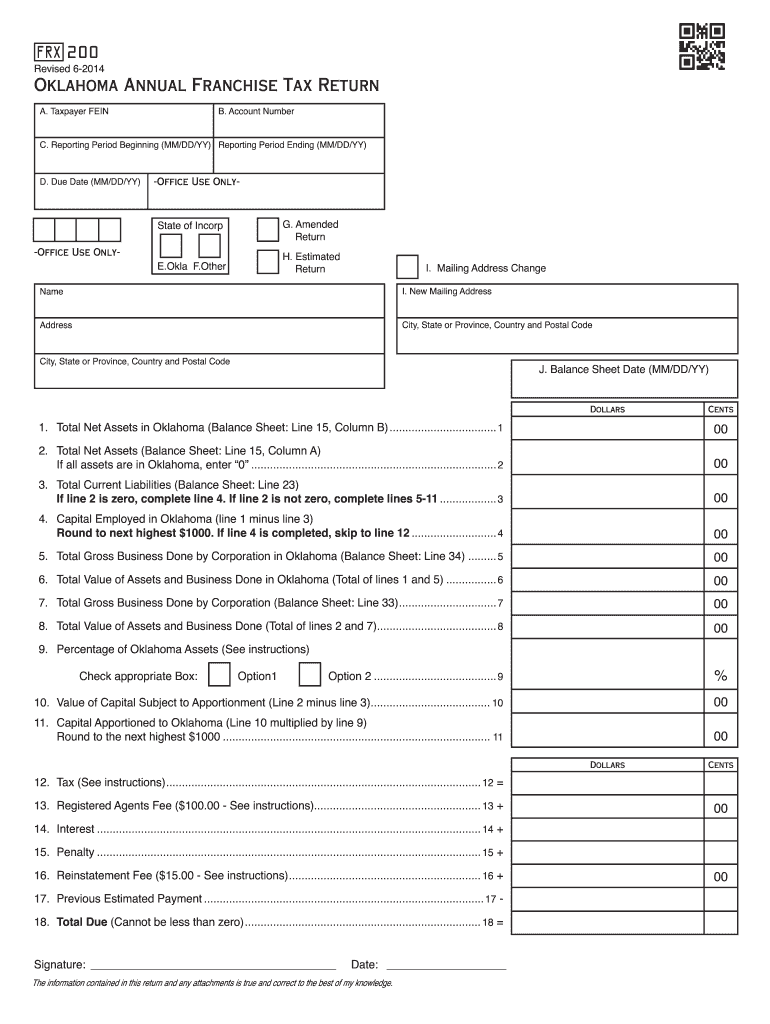

. Oklahoma has a flat corporate income tax rate of 6000 of gross incomeThe federal corporate income tax by contrast has a marginal. The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or. Up to 25 cash back Also in 2018 the amount of your corporations capital allocated invested or employed in Oklahoma was 250000.

Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma Streamlined Sales Tax. Companies are taxed on their total gross receipts. Other things being equal the.

Kevin Wallace the chair of the House Appropriations and Budget. Payment made payable to Oklahoma Tax Commission balance sheet and schedules A B C and D. Corporations are taxed 125 for each 1000 of capital invested or otherwise used.

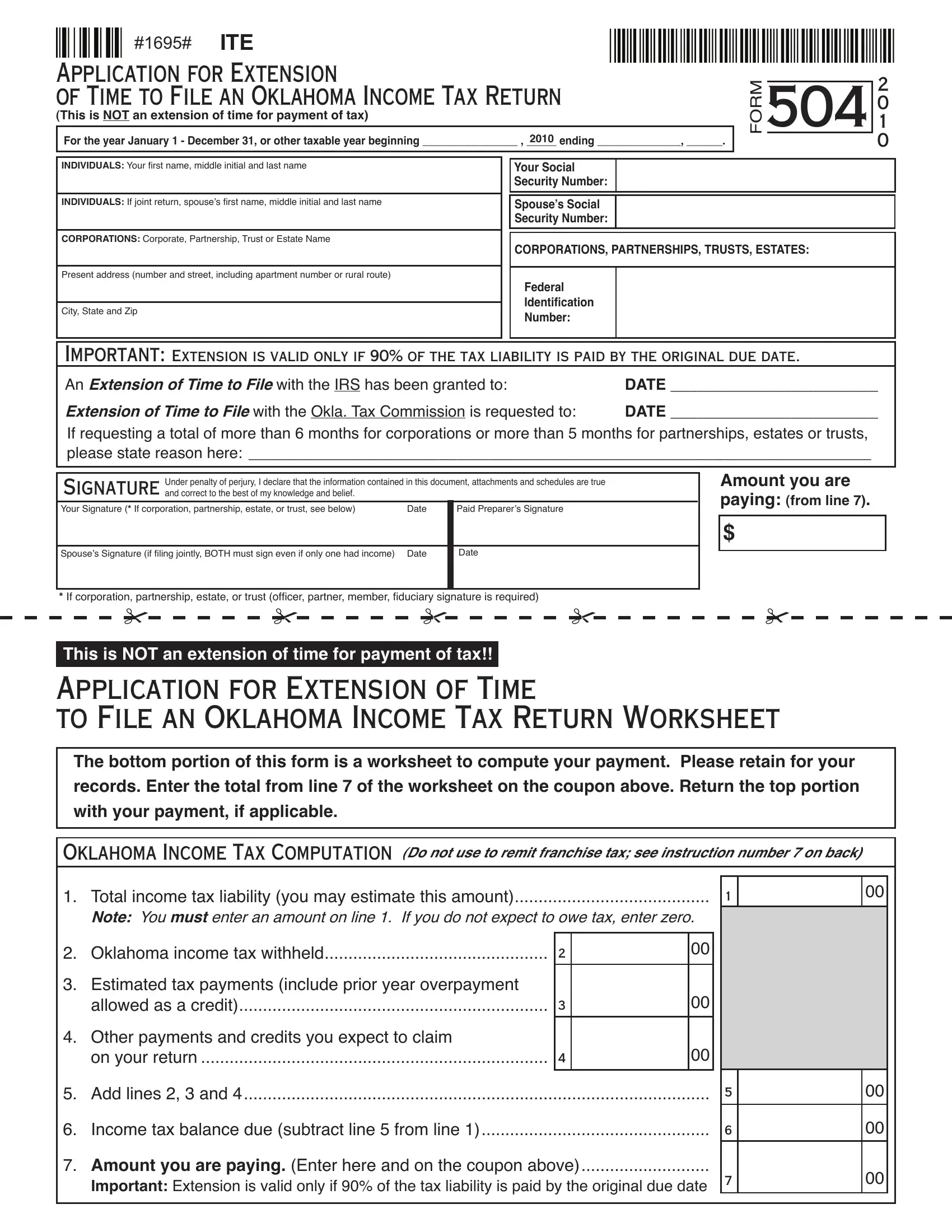

The rate is 125 for each 1000 of capital you invest or use in Oklahoma. Oklahoma Tax Commission Taxpayer Assistance Division Post Office Box. Time for Filing and Payment Information Oklahoma Franchise Tax is due and payable July 1st of each year unless a Franchise Election Form 200-F has been filed.

With the reorganization of the Oklahoma Tax Commission in 1995 came the refocus of the Tax Commissions goals and objectives. Oklahoma Tax Commission Franchise Tax Post Office Box 26930 Oklahoma. House Bill 1021 would phase out the states corporate income tax by 2030.

Oklahoma Tax Commission Payment Center. If you would like to add or change a Legal name in the Oklahoma Tax Commission fill out Packet A and mail to. Mine the amount of franchise tax due.

The Oklahoma Franchise Tax is a state tax levied against companies doing business within the borders of Oklahoma. You will be automatically redirected to the home page or you may click below to return immediately. Oklahoma levies a franchise tax on all corporations or associations doing business in the state.

For every 1000 of investment 125 of tax is levied with a maximum limit of 20000 in a. Copyright 2007 Oklahoma Tax Commission Security Statement Privacy Statement Feedback OKgov Last Modified 10222007. Not-for-profit corporations are not subject to franchise tax.

Oklahoma requires all corporations that do business in the state to pay a franchise tax. As out-of-control inflation strains families budgets lawmakers across the country are casting. All businesses and associations in Oklahoma are required to pay a Franchise tax.

Oklahoma Tax Commission PO Box 26890 Oklahoma City OK 73126-0890. The report and tax will be. Return with your payment if applicable to.

Foreign not-for-profit corporations however are still required to pay the 10000 registered agent fee. Form 512 Form 513 Form 512-E. Oklahoma Should Prioritize Pro-Growth Relief Not Gimmicky Rebate Checks.

Your session has expired.

Cherokee Chief Says No Oklahoma Income Tax For Indians Oklahoma Council Of Public Affairs

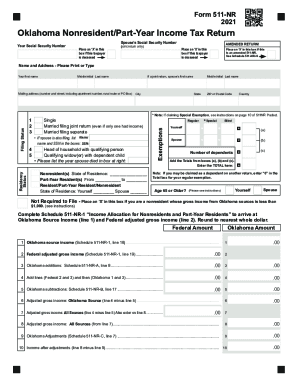

Oklahoma 511nr Form Fill Out And Sign Printable Pdf Template Signnow

New Push To Eliminate Personal Income Tax In Oklahoma Ktul

Form 511nr Oklahoma Nonresident Part Year Income Tax Return Youtube

State Income Tax Rates And Brackets 2022 Tax Foundation

State Says Income Tax Exemption For Tribal Citizens On Reservations Inapplicable Despite Existing Law

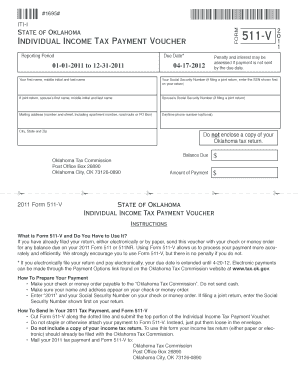

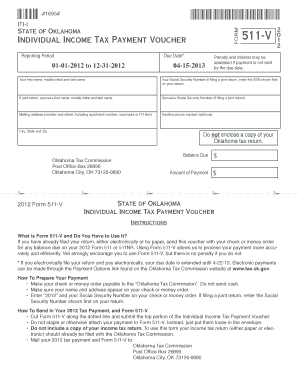

Business Filers Income Tax Payment Voucher Forms Ok Gov Oklahoma Digital Prairie Documents Images And Information

Want To Reduce Oklahoma S Public Services Hurt Local Business And Shrink Our Economy Eliminate The Corporate Income Tax Oklahoma Policy Institute

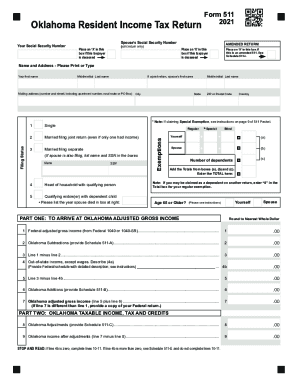

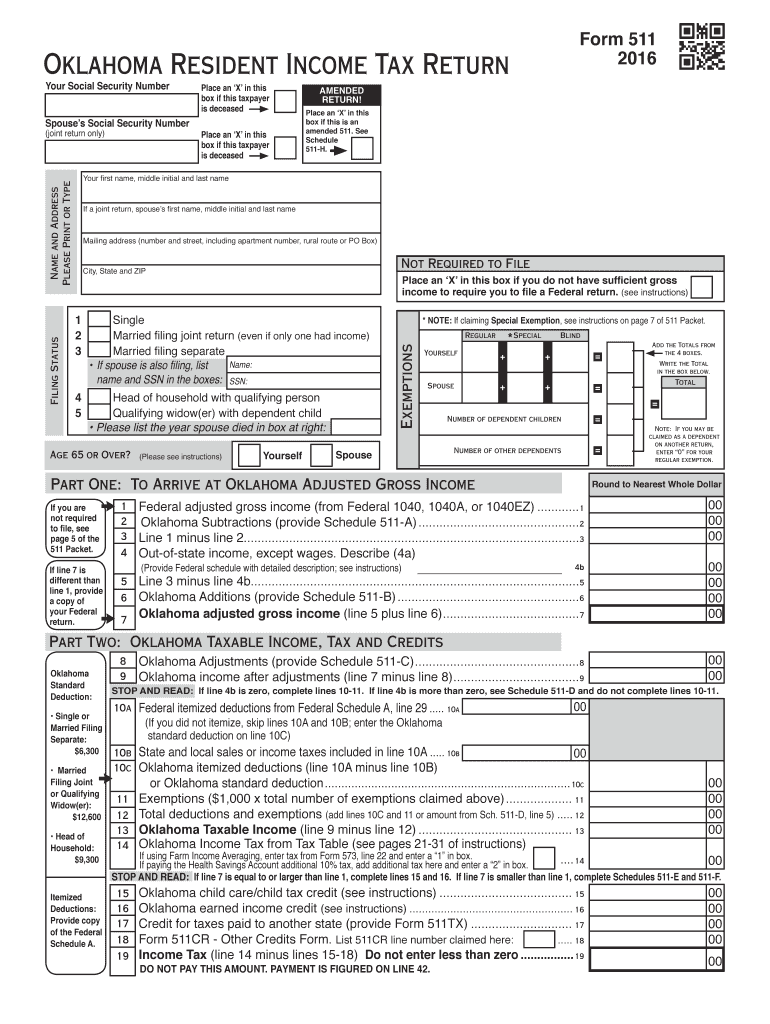

Fillable Oklahoma Form 511 Fill Out And Sign Printable Pdf Template Signnow

Fillable Online Tax Ok Individual Payment Voucher Form Fax Email Print Pdffiller

Free Form 511 Oklahoma Resident Income Tax Return And Sales Tax Relief Credit Form Free Legal Forms Laws Com

Ok Form 511 2014 Fill Out Tax Template Online Us Legal Forms

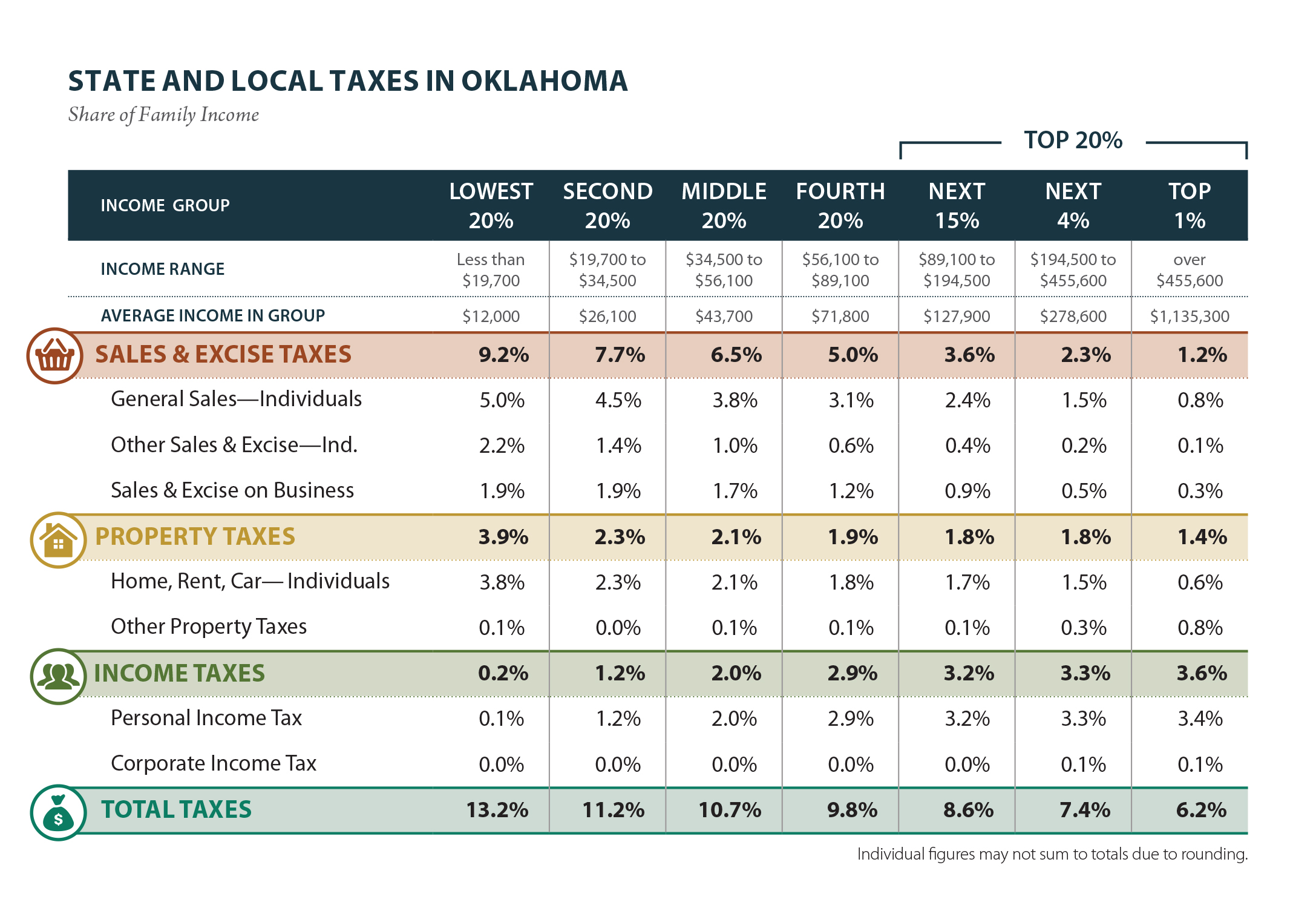

Who Pays State And Federal Taxes In Oklahoma In 2 Charts Oklahoma Policy Institute

Fillable Online Metrolibrary Print Oklahoma Tax Payment Voucher Form Fax Email Print Pdffiller

Fill Free Fillable Forms State Of Oklahoma

Oklahoma Tax Commission Rl030 Letter Sample 1